In a rapidly evolving digital landscape, the concept of tokenization has emerged as a powerful force driving the shift towards a decentralized future. But with the increasing complexity of the global financial ecosystem, navigating the roadmap to global tokenization can be a daunting task.

Welcome to ‘The Roadmap to Global Tokenization: Discovering the Path to a Decentralized Future. In this article, we will delve into the key strategies and insights that can help individuals and organizations understand and harness the potential of tokenizing on a global scale.

Whether you’re an investor looking to capitalize on the opportunities presented by tokenization, a business owner exploring how tokenization can enhance your operations, or simply curious about the world of decentralized finance, this article will provide you with the knowledge and insights you need to navigate the road to global tokenization.

Join us as we unravel the intricacies of tokenization, explore real-world use cases, and identify the challenges and opportunities that lie ahead. Get ready to embark on a journey towards a decentralized future where tokenizing is the driving force behind innovation and financial inclusion.

Table of Contents

What is tokenization and its role in a decentralized future?

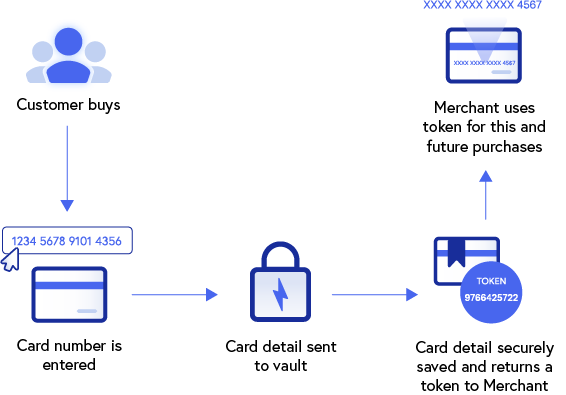

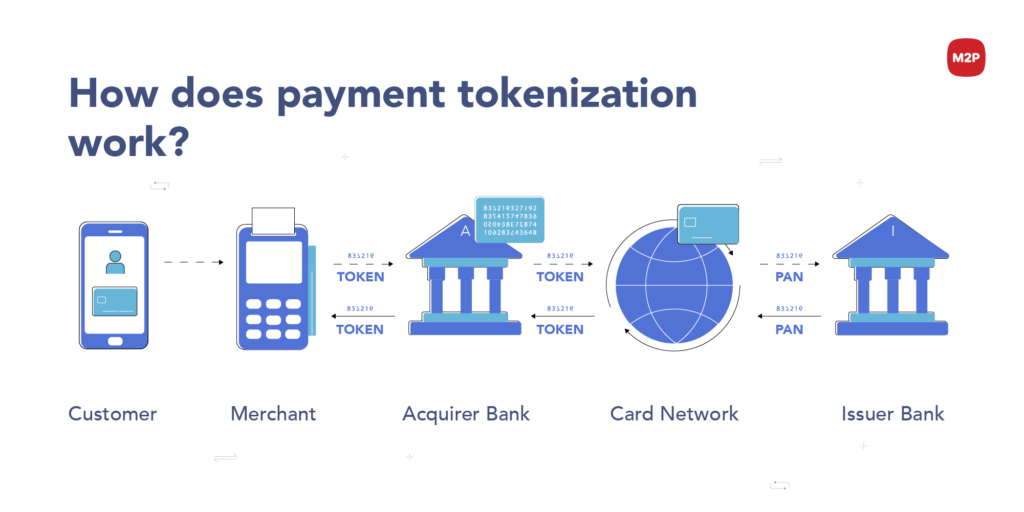

Tokenization is the process of converting real-world assets or rights into digital tokens that can be securely stored and transferred on a blockchain. These tokens represent ownership or access rights to the underlying assets, whether they are physical assets like real estate or commodities or financial assets like stocks and bonds. The tokenization of assets enables fractional ownership, increases liquidity, and eliminates the need for intermediaries, making it a key enabler of decentralization.

In a decentralized future, tokenization will play a crucial role in democratizing access to investment opportunities and financial services. By removing barriers to entry and enabling fractional ownership, tokenization opens up avenues for individuals who were previously excluded from traditional investment markets. It also promotes transparency, as blockchain technology ensures that token transactions are recorded on a public ledger, reducing the risk of fraud and manipulation.

Tokenization also has the potential to revolutionize industries beyond finance. For example, in the art world, tokenizing allows artists to tokenize their work, providing a direct link between creators and buyers while ensuring the provenance and authenticity of the artwork. Similarly, tokenizing can transform supply chains by enabling the tracking and verification of products from the source to the end consumer. The possibilities are endless, and tokenizing is poised to reshape economies and industries worldwide.

The benefits of tokenization in global markets

Tokenization offers numerous benefits in global markets, making it an attractive proposition for investors and businesses alike. One of the key advantages of tokenization is increased liquidity. By converting illiquid assets into digital tokens, tokenizing enables fractional ownership and facilitates the trading of these tokens on secondary markets. This opens up opportunities for investors to buy and sell tokens easily, thereby unlocking the value of previously illiquid assets.

Another benefit of tokenizing is enhanced efficiency. Traditional financial markets often involve multiple intermediaries and complex processes, leading to high transaction costs and delays. Tokenizing streamlines these processes by eliminating intermediaries, automating transactions, and reducing costs. This not only benefits investors but also enables businesses to access capital more efficiently and at a lower cost.

Furthermore, tokenization promotes financial inclusion by providing access to investment opportunities for individuals who were previously excluded from traditional markets. By lowering the barriers to entry, tokenizing allows anyone with an internet connection to invest in a wide range of assets, regardless of their location or financial status. This has the potential to empower individuals and communities, drive economic growth, and reduce inequality.

It’s important to note that tokenizing also offers benefits in terms of security and transparency. Blockchain technology, which underpins tokenization, ensures that transactions are recorded on an immutable and transparent ledger. This reduces the risk of fraud and manipulation, providing investors with greater confidence in the integrity of the assets they hold. Additionally, smart contracts, which can be embedded in tokens, automate the execution of contractual obligations, further enhancing security and reducing the need for trust in counterparties.

Tokenizing offers increased liquidity, enhanced efficiency, financial inclusion, security, and transparency. These benefits make tokenization an attractive option for investors and businesses looking to embrace a decentralized future.

Understanding blockchain technology and its connection to tokenization

To fully understand tokenization, it is essential to grasp the underlying technology that powers it – blockchain. Blockchain is a distributed ledger technology that enables the secure and transparent recording of transactions across multiple computers or nodes. It consists of blocks of data, each containing a list of transactions, which are linked together in chronological order to form a chain.

The decentralized nature of blockchain ensures that no single entity has control over the network, making it resistant to censorship and tampering. This decentralization is achieved through a consensus mechanism, where participants in the network validate and agree on the state of the ledger through a process called mining or staking.

Blockchain technology provides the foundation for tokenization by offering a secure and transparent infrastructure for the issuance, transfer, and management of digital tokens. Each token represents a specific asset or right and is uniquely identified and recorded on the blockchain. This ensures that ownership of the asset can be easily verified and transferred without the need for intermediaries.

Blockchain technology enables the automation of certain processes through the use of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute when predefined conditions are met, removing the need for intermediaries and reducing the risk of human error or fraud.

By leveraging the power of blockchain technology, tokenizing provides a decentralized and efficient solution for the representation and transfer of assets. It opens up new possibilities for financial innovation and unlocks value in previously illiquid markets.

The regulatory landscape of tokenization

As tokenization gains traction globally, regulators are grappling with how to effectively govern this emerging technology. The regulatory landscape for tokenizing varies across jurisdictions, with some countries embracing innovation and others taking a more cautious approach.

One of the key challenges for regulators is determining the legal status of tokens. Tokens can be classified into different categories, such as security tokens, utility tokens, or payment tokens, each with its own regulatory implications. Security tokens, for example, are subject to securities laws and regulations, while utility tokens may fall under consumer protection or anti-money laundering regulations.

Additionally, regulators are concerned about investor protection and market integrity. They aim to ensure that investors have access to accurate and reliable information about token projects and that market participants comply with anti-fraud and anti-money laundering regulations. Regulators are also focused on preventing market manipulation and ensuring the stability of financial markets.

The regulatory approach to tokenization varies across jurisdictions. Some countries, such as Switzerland and Singapore, have adopted a more favorable stance towards tokenization, providing clear guidelines and frameworks for token offerings and trading. Others, like the United States, have a more complex regulatory environment, with different regulatory bodies overseeing different aspects of tokenizing.

It is important for individuals and businesses to understand the regulatory requirements in their jurisdiction before engaging in tokenizing activities. Compliance with applicable laws and regulations is crucial to avoid legal and financial risks. As the regulatory landscape continues to evolve, it is expected that more clarity and harmonization will emerge, providing a more conducive environment for global tokenization.

The potential challenges and risks of global tokenization

While tokenizing holds immense promise, there are also challenges and risks that need to be addressed for its successful global adoption. One of the key challenges is the interoperability of different blockchain networks. Currently, there are multiple blockchain platforms, each with its own protocols and standards. This fragmentation hinders the seamless transfer of tokens across different networks and limits their liquidity and fungibility.

Scalability is another challenge that needs to be overcome. As blockchain networks become more popular and the number of transactions increases, scalability becomes a bottleneck. Currently, many blockchain networks struggle to handle a large number of transactions per second, leading to delays and high fees. Scalability solutions, such as layer 2 protocols or sharding, are being developed to address this issue, but widespread adoption is still a work in progress.

Another risk associated with tokenizing is the potential for fraud and scams. The decentralized and pseudonymous nature of blockchain networks makes it challenging to identify and prosecute bad actors. Individuals and businesses need to exercise caution and conduct thorough due diligence before participating in token offerings or investing in tokens.

Regulatory uncertainty is also a risk that can impact the global adoption of tokenization. As discussed earlier, the regulatory landscape for tokenization is still evolving, and compliance requirements can vary across jurisdictions. This uncertainty can deter businesses and investors from engaging in tokenizing activities, limiting its potential.

Lastly, there is the challenge of educating individuals and businesses about the benefits and risks of tokenization. Many people are still unfamiliar with blockchain technology and tokenization, and there is a need for increased awareness and understanding. Education and awareness campaigns can help dispel misconceptions and build trust in technology.

While these challenges and risks exist, they are not insurmountable. With ongoing research, innovation, and collaboration between stakeholders, these issues can be addressed, paving the way for the widespread adoption of tokenization on a global scale.

Developing a roadmap for global tokenization

To navigate the roadmap to global tokenization, it is essential to develop a strategic plan that takes into account the unique characteristics and challenges of the global financial ecosystem. Here are some key considerations when developing a roadmap for global tokenization:

Identify target markets and assets: Determine the markets and asset classes that are most ripe for tokenization. Consider factors such as the regulatory environment, market demand, and potential benefits of tokenizing in each market.

Build partnerships and collaborations: Tokenization requires collaboration between various stakeholders, including asset owners, technology providers, legal and regulatory experts, and investors. Identify and build partnerships with these stakeholders to leverage their expertise and resources.

Address regulatory and legal considerations: Understand the regulatory requirements in each target market and ensure compliance with applicable laws and regulations. Engage with regulators and industry associations to shape the regulatory landscape and advocate for favorable policies.

Develop robust technology infrastructure: invest in scalable and secure technology infrastructure to support token issuance, transfer, and trading. Consider interoperability between different blockchain networks and explore solutions that enhance scalability and usability.

Educate and raise awareness: Conduct educational campaigns to raise awareness about tokenization and its benefits. Target both businesses and individuals, providing them with the knowledge and resources to participate in tokenizing activities.

Mitigate risks and ensure security: Implement robust security measures to protect token holders from fraud and scams. Conduct thorough due diligence on token projects and establish best practices for token issuance and trading.

Monitor and adapt to regulatory changes: Stay updated on the evolving regulatory landscape and adapt the roadmap accordingly. Engage with regulators and industry associations to shape regulations and ensure compliance.

By following these strategic considerations and continuously adapting to the changing landscape, individuals and businesses can navigate the roadmap to global tokenization and unlock its full potential.

Case studies of successful global tokenization projects

To illustrate the real-world applications and benefits of global tokenization, let’s explore some case studies of successful tokenization projects:

Real estate tokenization: Real estate has traditionally been an illiquid asset class with high barriers to entry. Tokenizing allows fractional ownership of properties, enabling investors to buy and sell tokens representing shares in real estate assets. This increases liquidity and opens up investment opportunities to a wider audience. Projects like Harbor and Propy have successfully tokenized real estate assets, allowing investors to access global real estate markets.

Artwork tokenization: Historically, intermediaries have dominated and lacked transparency in the art market: Tokenization allows artists to tokenize their artwork, providing direct access to buyers and ensuring the provenance and authenticity of the artwork. Maecenas and Verisart are examples of platforms that enable the tokenizing of art, revolutionizing the way art is bought and sold.

Supply chain tokenization: Supply chains are often complex and opaque, making it challenging to track and verify products. Tokenizing can transform supply chains by creating digital tokens that represent products at each stage of the supply chain. This enables real-time tracking, verification, and transparency, reducing fraud and ensuring product authenticity. Projects like VeChain and Ambrosus are leveraging tokenization to enhance supply chain management in various industries.

These case studies demonstrate the transformative potential of tokenizing across different sectors. By tokenizing assets and rights, these projects are revolutionizing industries, enhancing liquidity, and promoting transparency and efficiency.

Tokenization platforms and tools for businesses and individuals

As the demand for tokenization grows, an ecosystem of platforms and tools has emerged to facilitate the tokenizing process for businesses and individuals. These platforms provide the necessary infrastructure and services to issue, transfer, and manage tokens.

Here are some notable tokenization platforms and tools:

Polymath: Polymath is a platform that enables the issuance of security tokens. It provides a comprehensive suite of tools and services to guide businesses through the tokenization process, from initial token creation to regulatory compliance.

OpenSea: OpenSea is a decentralized marketplace for non-fungible tokens (NFTs). It allows individuals to buy, sell, and trade NFTs representing digital assets such as artwork, collectibles, and virtual real estate.

MakerDAO: MakerDAO is a decentralized lending platform that enables individuals to borrow stablecoins by collateralizing their digital assets. It uses a system of smart contracts and oracles to maintain the stability of its stablecoin, DAI.

Harbor: Harbor is a platform for tokenizing and trading real estate assets. It provides a compliant framework for issuing and managing security tokens, allowing investors to access fractional ownership in real estate assets.

Chainlink: Chainlink is a decentralized oracle network that connects smart contracts with real-world data. Oracles are essential for tokenizing as they provide external information, such as asset prices or weather conditions, to trigger the execution of smart contracts.

These platforms and tools are just a few examples of the growing ecosystem that supports tokenization. As technology advances and the demand for tokenizing increases, we can expect to see more innovative platforms and tools emerge, providing businesses and individuals with greater flexibility and accessibility in the tokenization process.

The future of global tokenization and its impact on various industries

The future of global tokenization is bright, with the potential to revolutionize industries and reshape economies worldwide. As the technology matures and regulatory frameworks become more established, we can expect to see increased adoption and integration of tokenizing in various sectors.

In the financial industry, tokenizing has the potential to disrupt traditional banking structures and offer unprecedented opportunities for both investors and consumers. Through the creation of digital tokens that represent real-world assets, liquidity can be enhanced, transaction costs reduced, and access to capital markets expanded. This could democratize finance, providing small investors with opportunities previously reserved for institutional investors.

In the real estate sector, tokenizing can make property investment more accessible and transparent, breaking down barriers to entry and enabling fractional ownership. This could foster greater diversity and innovation within the property market, creating new avenues for growth.

Healthcare, supply chain management, and intellectual property are also areas where tokenizing could bring transformative changes. By streamlining processes and improving security through blockchain technology, tokenization has the potential to increase efficiency, transparency, and trust across various industries.

However, the road to full adoption is not without challenges. Regulation, technology standardization, and public perception will play significant roles in shaping the future of tokenization. Collaborative efforts between governments, technology providers, and industry leaders will be essential in creating a supportive environment that fosters innovation while ensuring security and compliance.

The future of global tokenization is filled with promise, offering a myriad of possibilities to reshape the way we conduct business and engage with assets. As platforms and tools continue to evolve, embracing tokenization could become an essential strategy for those looking to thrive in the modern economy.

The next few years will likely witness a surge in tokenization initiatives as organizations across the globe recognize its potential and work together to unlock its full benefits. Whether in finance, real estate, or other sectors, tokenization stands as a testament to human ingenuity and the relentless pursuit of progress. This represents a step towards a more inclusive and efficient world, where opportunities are not limited by traditional barriers but are accessible to all who seek them.

🚀Ready to embark on your crypto journey?💰🔒Secure, simple and rewarding – Crypto.com is your gateway to the future of finance!🌐💎Click here 👉👇to begin your adventure in the crypto universe today

💼 Show your crypto flair! 💫 Dive in here 👇 for our special merchandise 🎉

🚨DISCLAIMER🚨

Investingcrypto717.com’s 🌐 content is solely educational🎓. NOT financial advice🙅♂️💼. Do your own research🔍💡, consult a professional before investing💼🤝. You invest at your own risk⚠️💸. #NotFinancialAdvice #InvestingCrypto717🔐🌍