The Genesis of Bitcoin

In the aftermath of the 2008 global financial crisis, a novel concept was introduced that challenged conventional financial systems. An entity known as Satoshi Nakamoto introduced Bitcoin, a decentralized peer-to-peer digital currency, through a nine-page whitepaper. With its transparency and autonomy from government control, Bitcoin has emerged as an alternative to traditional financial institutions that many have come to view as untrustworthy and unstable.

The whitepaper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” laid the groundwork for a decentralized payment system that would allow online payments to be sent directly between parties without passing through a financial institution. It also proposed solutions to problems faced by previous attempts at digital cash, such as double spending, by implementing a timestamp server on a peer-to-peer basis.

Table of Contents

The Infrastructure: Blockchain and Mining

Blockchain technology, a decentralized ledger that maintains a continuously expanding list of transactions organized into blocks, serves as the foundation for bitcoin. Each block is linked to the preceding one, forming a chain. This chain of blocks is maintained across multiple computers in a peer-to-peer network, ensuring that no single entity has control over the information and thereby enhancing security and trust in the system.

Mining is the process by which new bitcoins are created and transactions are added to the blockchain. This involves solving complex computational puzzles that require significant computing power and energy. Mining also maintains the security of the Bitcoin network because manipulating transaction data would require control over at least 51% of the total computational power in the network, which is virtually impossible because of the distributed nature of the network.

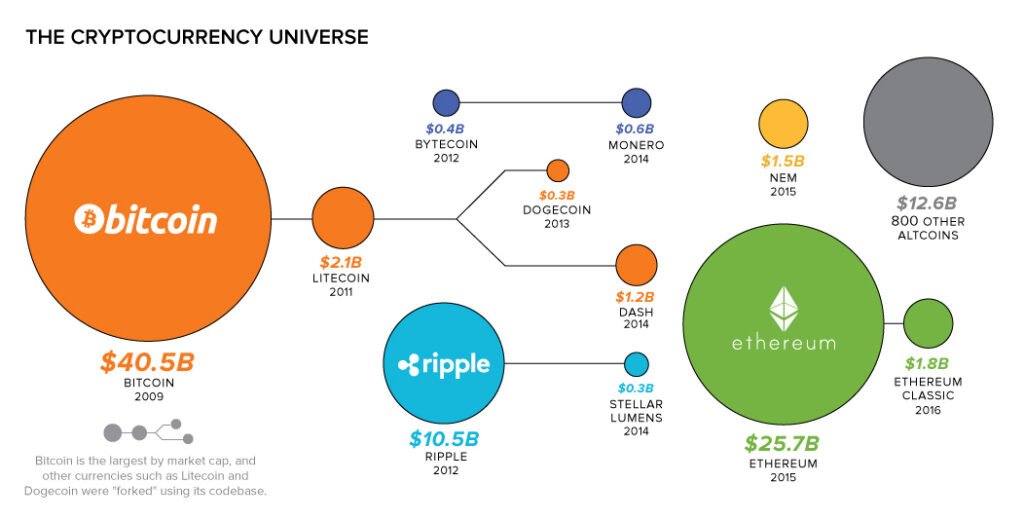

The Emergence of Altcoins

The success of Bitcoin sparked an avalanche of alternative cryptocurrencies, commonly referred to as altcoins. These altcoins sought to build upon Bitcoin’s revolutionary concept of addressing perceived limitations and expanding the use of blockchain technology. For instance, former Google engineer Charlie Lee developed Litecoin in 2011 as a “lighter” version of Bitcoin. By creating blocks four times faster than Bitcoin, this was possible, leading to quicker transaction confirmations.

Ethereum: A Game Changer

In 2015, the cryptocurrency landscape experienced a significant shift following the advent of Ethereum, In which Vitalik Buterin founded, introduced a blockchain platform capable of carrying out smart contracts, or self-executing contracts with terms written directly into lines of code. This made Ethereum’s blockchain programmable, which opened the door to a broad array of decentralized applications (dApps).

The Diversification of Cryptocurrencies

The introduction of smart contracts led to an explosion of new altcoins, each catering to different needs and use cases. Some cryptocurrencies focused on privacy (Monero, Zcash), while others centered on utility within a specific ecosystem (Binance Coin) or on compatibility and integration with existing financial institutions (Ripple).

Moreover, Ethereum’s smart contracts gave birth to an entire subsector of crypto assets—tokens. Unlike cryptocurrencies, which have their own independent blockchains, tokens are built on top of other blockchains. This led to an increase in Initial Coin Offerings (ICOs), a method of raising funds for new projects by selling tokens to investors.

The Challenges and Controversies

Although cryptocurrencies have opened up a realm of possibilities, they have also faced significant challenges. Regulatory uncertainty is among the most prominent factors. Governments and regulatory bodies worldwide have grappled with defining and controlling these novel digital assets, often scrambling to catch up with rapid advancements in technology.

Cryptocurrencies have also been embroiled in controversies over their use in illicit activities, from money laundering to financing terrorism. The largely unregulated and anonymous nature of transactions on many cryptocurrency networks makes them attractive for such activities.

Environmental Concerns

Bitcoin and other cryptocurrencies that rely on proof-of-work consensus mechanisms have come under fire because of their significant energy consumption and the resulting environmental impact. This has spurred the development of more energy-efficient consensus mechanisms, such as proof-of-stake (PoS), as well as ongoing debates about the true cost and value of decentralized digital currencies.

Looking Ahead

As of mid-2023, there are over 10,000 different cryptocurrencies in existence, with a total market capitalization exceeding $2 trillion. Although the sector continues to face challenges and uncertainties, the burgeoning cryptocurrency ecosystem is a testament to the potential of this disruptive technology.

From the inception of Bitcoin to the proliferation of altcoins and tokens, the cryptocurrency landscape continues to redefine our understanding of money and finance. As we look ahead, the question is no longer whether cryptocurrencies will be part of our future but how they will reshape it.

The Advent of Stablecoins and DeFi

A significant evolution in the cryptocurrency space was the creation of stablecoins, cryptocurrencies designed to minimize price volatility. Stablecoins are typically pegged to a stable asset such as the U.S. dollar or gold. Examples include tether (USDT), USD Coin (USDC), and DAI. Their stability in price relative to other cryptocurrencies makes them a key component of cryptocurrencies and an ideal medium of exchange.

Decentralized Finance (DeFi) is another innovation arising from the flexibility of Ethereum’s smart contracts. DeFi applications aim to recreate and improve traditional financial systems, such as loans, insurance, and trading, without intermediaries. Aave, Uniswap, and Compound are prominent players in this space, offering services ranging from lending and borrowing to automated market making.

The Rise of NFTs

Blockchain also serves as the foundation for Non-Fungible Tokens (NFTs), digital tokens representing the ownership or proof of authenticity of unique items or pieces of content. Unlike cryptocurrencies or tokens, in which each unit is identical (fungible), each NFT has a distinct value and specific information that makes it unique. This technology has seen particular applications in the art world, where it is used to buy, sell, and trade digital artwork, revolutionizing the way artists monetize their works.

Crypto Adoption and Integration

In its early years, cryptocurrency was often met with skepticism and considered a fringe technology, but there has been significant adoption and integration into mainstream systems over the last decade. Numerous businesses now accept Bitcoin and other cryptocurrencies as payments, and blockchain technology is being explored and adopted by various industries for many applications.

Additionally, we are seeing increasing institutional interest in cryptocurrencies. The landscape is rapidly changing, from investment funds buying Bitcoin and other cryptocurrencies as part of their portfolios to banks exploring blockchain technology for their operations.

The Arrival of CBDCs

The transformative potential of blockchain technology has also been recognized by governments worldwide, resulting in the exploration and development of Central Bank Digital Currencies (CBDCs). CBDCs are the digital form of a country’s fiat currency and are backed by the country’s central bank. Unlike decentralized cryptocurrencies, CBDCs are centralized; however, they borrow heavily from blockchain technology.

Potential Challenges Ahead

Although the future of cryptocurrencies appears promising, it is not without potential hurdles. Regulatory challenges persist, with concerns about consumer protection, illicit activities, and financial stability. However, technological challenges also exist. Scalability issues must be resolved for cryptocurrencies to compete with established payment systems.

Moreover, the question of interoperability, that is, how different blockchain networks can interact and work together, remains. Solving this problem could unlock a new level of functionality and enable even more complex systems.

Despite these challenges, the narratives of Bitcoin and altcoins are not merely about creating a new type of currency. It is about revolutionizing our approach to financial systems and transactions, digitizing and democratizing finance, and potentially transforming numerous other sectors, from supply chains to contract law.

Since its birth amid a global financial crisis, Bitcoin has sparked a technological revolution that continues to have reverberations across the globe. The story of cryptocurrencies is still being written, and as we move forward, it is clear that they represent an integral part of the evolving digital landscape.