Understanding the Bitcoin halving

The Bitcoin halving is a significant event in the world of cryptocurrency. It refers to the procedure that reduces the reward for mining new Bitcoin blocks by 50%. This event occurs approximately once every four years and is programmed into the Bitcoin protocol. The purpose of the halving is to control the supply of Bitcoin and ensure that it remains a scarce resource.

Table of Contents

The significance of the Bitcoin halving

The Bitcoin halving has had a profound impact on the market. By reducing the rate at which new Bitcoins are created, the halving increases scarcity and can lead to an increase in the value of Bitcoin. This has historically resulted in bull runs, where the price of Bitcoin skyrocketed.

🌟 Your Secret Careerist Invite! 🚀

Historical Bitcoin halving events and their impact on the market

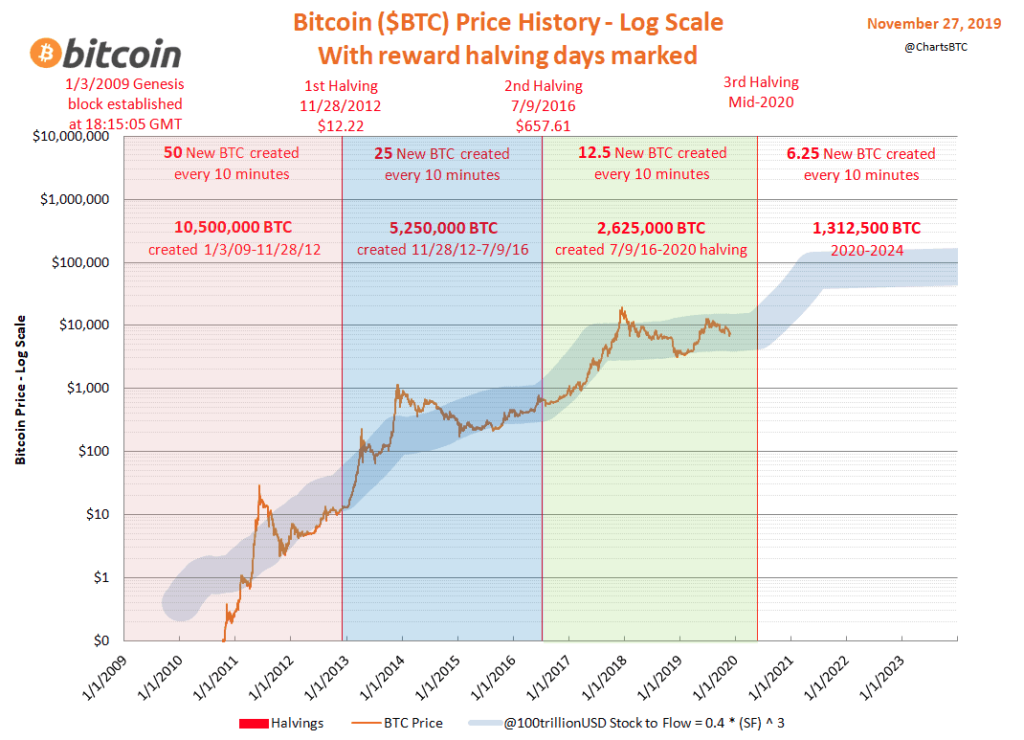

Looking back at previous Bitcoin halving events, we can see a clear pattern of price increases in the months leading up to and following the halving. In 2012, the first halving saw the price of Bitcoin increase from around $12 to over $1000 within a year. Similarly, the second halving in 2016 saw the price of Bitcoin surge from $600 to nearly $20,000 in less than two years.

Predicting the next Bitcoin halving date

The halving events are predetermined and can be accurately predicted based on the Bitcoin protocol. The next halving is expected to occur in 2024. However, it’s important to note that the exact date and time of the halving may vary slightly due to the unpredictable nature of block generation.

🎄 CHRISTMAS SALE: Elevate Your Tech Career! 🚀

The 2024 Bull Run and its potential impact on Bitcoin

The 2024 Bull Run is anticipated to coincide with the next bitcoin halving. A bull run refers to a period of significant price increases in the cryptocurrency market. The combination of the halving and the potential market frenzy can result in exponential gains for Bitcoin investors.

Strategies for capitalizing on the 2024 Bull Run and Bitcoin halving

To make the most of the 2024 Bull Run and Bitcoin halving, it’s crucial to develop a well-thought-out strategy. Here are some key strategies to consider:

Dollar-cost averaging: Invest a fixed amount of money into Bitcoin at regular intervals, regardless of the price. This strategy helps to mitigate the risk of buying at the peak of the market.

HODL: Hold your bitcoin for an extended period, even during volatile market conditions. This strategy is based on the belief that the long-term value of Bitcoin will continue to rise.

Diversify: Consider diversifying your cryptocurrency portfolio to include other promising cryptocurrencies. This can help spread the risk and potentially increase overall gains.

Bitcoin halving charts and their analysis

Bitcoin halving charts provide valuable insights into the historical price movements surrounding halving events. By analyzing these charts, investors can identify patterns and trends that may help inform their investment decisions. It’s important to note that past performance is not indicative of future results, but studying historical data can provide valuable insights.

💼 Elevate your QA game with these Automation Courses! 🚀 Master scripting, testing frameworks, and more. Take the next step in your career journey now!

Key factors to consider when planning for early retirement in the context of the Bitcoin halving

Planning for early retirement in the context of halving requires careful consideration of various factors. Here are some key factors to keep in mind:

Risk tolerance: Determine your risk tolerance and align your investment strategy accordingly. Bitcoin investments can be highly volatile, and it’s important to assess your comfort level with potential fluctuations in value.

Time horizon: Consider your time horizon for retirement. Bitcoin investments are generally considered long-term investments, and it’s crucial to align your investment strategy with your retirement goals.

Financial planning: Develop a comprehensive financial plan that takes into account your retirement goals, current financial situation, and potential investment returns. Seek advice from a qualified financial advisor to ensure your plan is tailored to your specific needs.

🚀Ready to embark on your crypto journey?💰🔒Secure, simple and rewarding – Crypto.com is your gateway to the future of finance!🌐💎Click here 👉👇to begin your adventure in the crypto universe today

Investment options for maximizing gains during the Bitcoin halving

Maximizing gains during the halving process requires careful consideration of investment options. Here are some strategies to consider:

Direct investment: Purchase Bitcoin directly from a reputable cryptocurrency exchange and hold it in a secure wallet. This allows you to benefit directly from any increase in Bitcoin’s value.

Bitcoin mining: Consider investing in Bitcoin mining equipment or joining a mining pool. Mining involves solving complex mathematical problems to validate transactions and earn new bitcoins.

Cryptocurrency funds: Invest in cryptocurrency funds that offer exposure to a diversified portfolio of cryptocurrencies, including Bitcoin. This can provide a more balanced approach to investing in the crypto market.

Risks and challenges to be aware of when strategizing for early retirement amidst the Bitcoin halving

While the Bitcoin halving presents opportunities for early retirement, it’s important to be aware of the risks and challenges involved. Here are some key considerations:

Volatility: Bitcoin is known for its high volatility, and the price can fluctuate dramatically in short periods. This volatility can pose challenges for retirement planning, as it may affect the value of your investments.

Regulatory uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving. Changes in regulations can impact the value and legality of cryptocurrencies, which may affect your retirement plans.

Security risks: Investing in Bitcoin requires careful attention to security. Cryptocurrency exchanges and wallets can be vulnerable to hacking and theft. It’s crucial to take appropriate measures to safeguard your investments.

Resources and tools for staying updated on Bitcoin halving news and market trends

Staying updated on Bitcoin halving news and market trends is essential for making informed investment decisions. Here are some resources and tools to help you stay informed:

Cryptocurrency news websites: Websites such as CoinDesk, Cointelegraph, and Bitcoin Magazine provide up-to-date news and analysis on Bitcoin and other cryptocurrencies.

Social media: Follow reputable cryptocurrency influencers and experts on platforms like Twitter and YouTube. They often provide valuable insights and updates on market trends.

Cryptocurrency tracking apps: Use cryptocurrency tracking apps like CoinMarketCap or Blockfolio to monitor the price and performance of Bitcoin and other cryptocurrencies.

💼 Master Sales Engineering essentials! 🛠️ these concise courses cover it all. Elevate your career with practical knowledge and hands-on experience

Final Thought

As we delve further into the prospect of the 2024 Bull Run and the Bitcoin Halving, it becomes evident that these events are not just opportunities but potential game-changers for those who approach them with the right strategy. Early retirement, a dream for many, might become a reality with the right moves in the crypto space.

One of the key elements that make the 2024 Bull Run so intriguing is the Bitcoin Halving. This event, which occurs approximately every four years, has historically been a catalyst for surges in the value of Bitcoin. The mechanism behind it is simple yet profound. Half the number of new Bitcoins enters the market, which frequently causes an increase in demand and a subsequent rise in prices. For investors, this presents a golden opportunity.

💼 Show your crypto flair! 💫 Dive in here 👇 for our special merchandise 🎉

To seize this opportunity, one must be equipped with a sound investment strategy. Diving into the world of cryptocurrency without a clear plan is akin to navigating uncharted waters without a map. It’s crucial to diversify your portfolio, spread the risk, and avoid putting all your eggs in one digital basket. Additionally, consider setting a budget for your investments and sticking to it. This disciplined approach can safeguard your financial stability while allowing you to explore the exciting possibilities presented by the 2024 Bull Run.

Moreover, it’s essential to take into account various factors that can influence the cryptocurrency market. Regulatory changes, global economic conditions, and technological advancements can all impact the crypto landscape. Staying informed about these factors is vital for making informed investment decisions. This knowledge empowers you to adapt your strategy as needed, ensuring that you’re well-prepared for whatever the market throws your way.

Despite the promise of great rewards, it’s equally crucial to acknowledge the risks involved in the cryptocurrency space. The market’s notorious volatility can lead to significant fluctuations in prices, and it’s not uncommon for some projects to fail. Therefore, it’s advisable to invest only what you can afford to lose, thereby mitigating potential losses.

🔥 BOOST YOUR QA CAREER! Embark on a transformative learning experience in QA Automation Engineering, starting from ground zero. Gain the skills needed to secure a job within a year, or get your money back.

The 2024 Bull Run and Bitcoin Halving are exciting prospects for those with their sights set on early retirement. With a well-thought-out investment strategy, a keen eye on influencing factors, and a healthy respect for the inherent risks, you can harness the potential of these events to secure your financial future. As with any investment, it’s all about balance, strategy, and careful consideration. By doing so, you can make the most of this opportunity, turning a dream retirement into a reality in the crypto world.

CTA: Start strategizing for early retirement amidst the Bitcoin halving today. Consult with a financial advisor and stay informed on market trends to make informed investment decisions. Remember to approach Bitcoin investments with caution and consider the risks involved.

🚀Ready to embark on your crypto journey?💰🔒Secure, simple and rewarding – Crypto.com is your gateway to the future of finance!🌐💎Click here 👉👇to begin your adventure in the crypto universe today

💼 Show your crypto flair! 💫 Dive in here 👇 for our special merchandise 🎉

🚨DISCLAIMER🚨

Investingcrypto717.com’s 🌐 content is solely educational🎓. NOT financial advice🙅♂️💼. Do your own research🔍💡, consult a professional before investing💼🤝. You invest at your own risk⚠️💸. #NotFinancialAdvice #InvestingCrypto717🔐🌍