In recent years, the world has witnessed an explosion of decentralized finance, Web3 and chainlink has been at the forefront of this revolution. This innovative blockchain oracle network has not only reshaped the landscape of blockchain technology but also rethought the entire concept of financial services through its Web3 service platform and strategic partnerships with leading financial institutions.

Table of Contents

Chainlink, the Pillar of Blockchain

At the heart of Chainlink’s system is its fundamental technology, blockchain, which is a decentralized and immutable distributed ledger that securely stores data across a network of servers. Blockchain guarantees data integrity and transparency, which are indispensable for financial transactions.

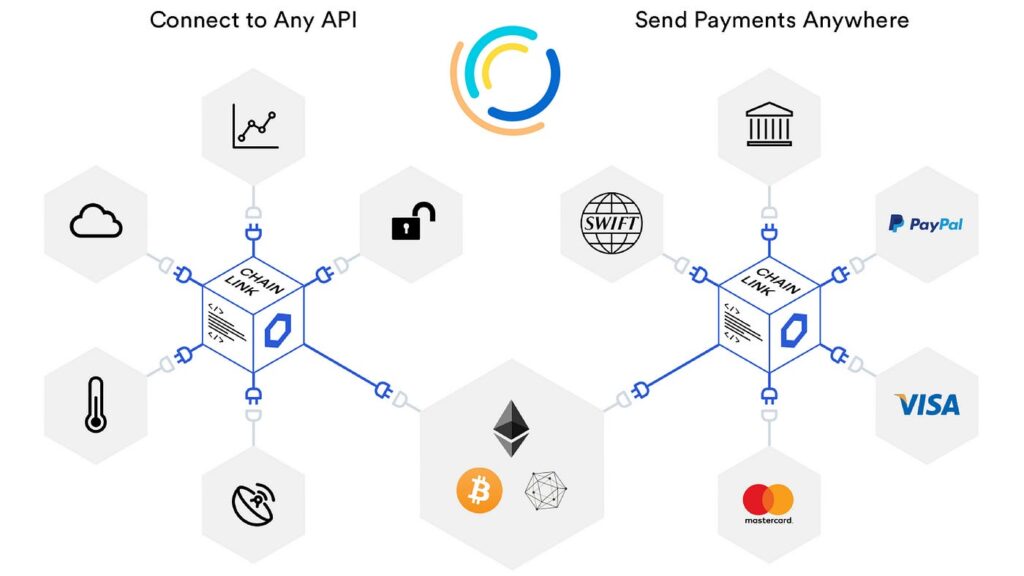

Nevertheless, the inability of blockchains to interact with off-chain real-world data has traditionally impeded the widespread adoption of blockchain in financial services. In this area, chainlink oracle technology has altered the terrain. As an oracle, Chainlink securely connects blockchains to external data sources, APIs, and traditional bank payment systems, acting as a bridge between blockchain and the rest of the world.

Chainlink’s Web3 Service Platform A Game-Changer

The decentralized Web3 service platform of Chainlink expands the capabilities of blockchain technology. The platform utilizes the power of smart contracts, which are contracts whose provisions are encoded in computer code and automatically executed. Without the need for intermediaries, these smart contracts facilitate, verify, and enforce the negotiation or performance of contracts. To function, smart contracts require real-world data, which traditional blockchain systems were unable to provide until Chainlink.

The Web3 service platform utilizes Chainlink’s decentralized oracle network to securely fetch real-world data for these smart contracts, making it a hub for developing smart contracts and a conduit for integrating these smart contracts with the real world. In the financial services industry, where contractual obligations depend on real-time data inputs such as interest rates, asset prices, and exchange rates, this capability is invaluable.

Strategic Partnerships Linking with Financial Institutions

Oracle technology and the Web3 platform from Chainlink have demonstrated enormous potential for disrupting traditional financial systems. Numerous prominent financial institutions have formed strategic partnerships with Chainlink, facilitating their integration with blockchain technology and allowing them to provide transparent, secure, and efficient financial services.

SWIFT, the global provider of secure financial communication services, has a significant partnership. By leveraging Chainlink’s oracle network, SWIFT has enabled its clients to construct self-executing smart contracts that interact with external data and off-chain payment systems. This represents a revolutionary development for global interbank transactions.

In the realm of decentralized finance (DeFi), Chainlink has partnered with Aave, a protocol regarded as the leader. This cooperation enables Aave to gain access to trustworthy and tamper-proof price feeds via Chainlink’s oracles, ensuring the security and dependability of its lending and borrowing services.

Chainlink has recently collaborated with the World Economic Forum (WEF) to investigate how blockchain and smart contract technology can contribute to a more inclusive and sustainable financial system. This high-profile partnership confirms the transformative potential of Chainlink’s technology in global financial systems.

Chainlink has partnered with IC3 (Initiative for Cryptocurrencies and Contracts), an academic research organization comprised of scholars from prestigious institutions. This partnership seeks to advance the research and development of Oracle technology and its financial service applications.

Defining Financial Futures

As the world increasingly embraces digital transformation, the importance of Chainlink’s function as a facilitator of blockchain technology in financial services has grown. Chainlink’s position as a transformative actor in the world of finance is supported by its Web3 service platform and its strategic partnerships with leading financial institutions.

In the future, the continuous expansion and development of the Chainlink platform will refine the ways in which blockchain technology can be integrated with conventional financial systems. As financial institutions increasingly rely on blockchain and smart contract technology to innovate and optimize their services, the importance and demand for Chainlink services will continue to rise.

With each partnership chainlink not only connects blockchain to the world but also reshapes the global financial future. The intersection of blockchain technology and financial services represents a new frontier in finance, and Chainlink is leading the way with its innovative solutions and strategic alliances.

Navigating the Practical Challenges

By bridging the gap between blockchain and the real world, Chainlink has unleashed a torrent of innovative financial services applications. However, the path to widespread adoption has not been devoid of obstacles. Interoperability, scalability, and regulatory issues continue to be formidable obstacles. Chainlink has made progress in overcoming these obstacles, paving the way for a future that is more interconnected and decentralized.

In terms of interoperability, Chainlink’s oracle networks provide a unified layer that enables various blockchain platforms to communicate with one another and with external systems, regardless of the underlying blockchain protocol. In a sector as diverse as financial services, systems founded on different standards and protocols must interact seamlessly. This characteristic is crucial.

To address scalability, Chainlink has been incorporating layer-2 solutions, which offer faster transaction speeds and lower transaction fees while preserving the blockchain’s decentralized security model. One solution is Off-Chain Reporting (OCR) enhancement, which reduces the amount of on-chain computation required by oracle networks, thereby improving scalability.

Regulatory issues present complex obstacles. Blockchain technology and decentralized finance represent a new frontier, and regulatory frameworks are still playing catch-up. Chainlink actively leads discussions and contributes to the development of regulatory guidelines. Its partnership with the World Economic Forum is emblematic of these initiatives.

Important Use Cases in the Financial Industry

Several transformative implementations in financial services have resulted from Chainlink’s partnerships. Using Chainlink’s data flows, for instance, fintech companies can provide DeFi products such as stablecoins, derivatives, and prediction markets. Using these data feeds, insurance companies can create parametric insurance products in which payouts depend on a predefined set of rules using data provided by Chainlink’s oracles.

The partnership with SWIFT has led to the development of smart contracts for interbank transactions. When certain conditions are met, such as obtaining payment confirmation from another bank, these smart contracts automatically execute transactions. This innovation significantly reduces transaction times and increases the efficiency of the banking sector.

Chainlink’s technology enables financial institutions to access the DeFi market, which was previously inaccessible because of the limitations of blockchain. By incorporating Chainlink’s oracle technology, financial institutions can now provide a broader array of services, including blockchain-based loans and interest-bearing accounts.

Looking Towards the Future

The potential future impact of Chainlink on the financial industry is enormous. Its technology can make financial systems more efficient, inclusive, and transparent, fundamentally altering how individuals and institutions manage and transact value.

Chainlink is well-positioned to continue driving this transformation as more financial institutions recognize the benefits of integrating blockchain technology. The creation of more sophisticated smart contracts, propelled by dependable and diverse real-world data gleaned from Chainlink’s oracle network, will enable a vast array of new financial products and services.

Chainlink’s ongoing research and development efforts, especially its partnership with IC3, will ensure that technology remains at the vanguard of the blockchain revolution. These initiatives promise additional advancements in oracle technology, such as the development of more robust, scalable, and secure oracle networks, which will further expand the financial applications of blockchains.

Chainlink’s Web3 service platform and its strategic partnerships with financial institutions represent a turning point in the financial industry’s evolution. Chainlink has paved the way for a new era of financial services, represented by increased transparency, efficiency, and inclusivity, by integrating blockchain technology with real-world data. Thus far, its journey has provided a view of the potential future of finance, which is Decentralized, Democratic, and Trustworthy.