The dynamic world of digital currencies offers numerous opportunities and obstacles. Dollar Cost Averaging (DCA) has demonstrated significant potential Among the numerous investment strategies that have emerged, DCA is a strategy that entails investing a constant dollar amount in a specific asset at regular intervals, regardless of the asset’s valuation. Crypto.com is a platform that has received praise for facilitating DCA.

Table of Contents

Understanding Dollar Cost Averaging (DCA)

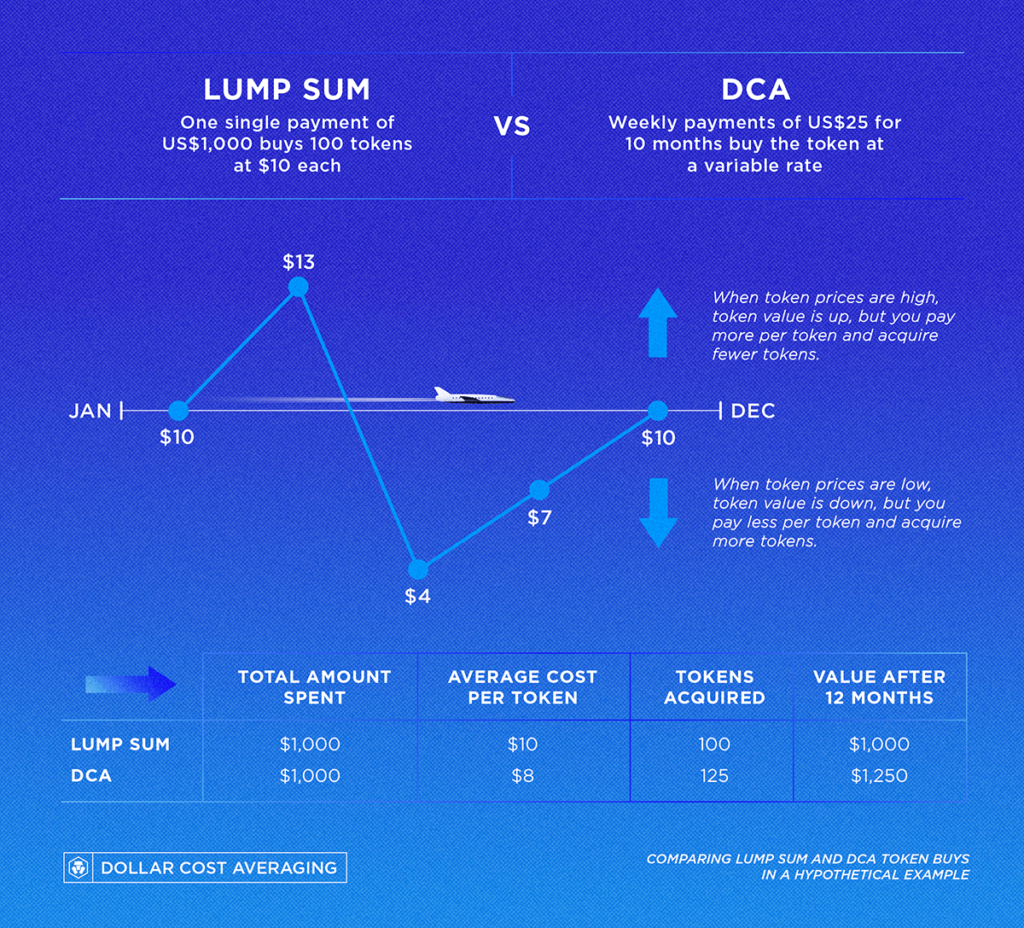

DCA is a strategy that assists investors in navigating the inherent risks of volatile investments such as cryptocurrencies. Instead of investing a large sum of money in a cryptocurrency all at once, those utilizing DCA will invest in smaller, consistent quantities over time. This strategy entails purchasing more of the asset when prices are low and less when they are high, resulting in a lower average unit cost.

Introducing DCA to Crypto.com

With its user-friendly interface and extensive list of supported cryptocurrencies, Crypto.com is an ideal platform for implementing a DCA strategy. Here’s how to get started with DCA on Crypto.com:

Account Creation: The first stage is account creation on Crypto.com, which includes basic identity verification for security purposes.

Choosing Your Cryptocurrency: Crypto.com supports a wide variety of cryptocurrencies, allowing you to choose the one that best correlates with your investment objectives and risk tolerance.

Setting Recurring Buy: In the “Trade” section, there is a “Recurring Buy” feature that enables you to schedule recurring purchases of your preferred cryptocurrency.

Defining Your DCA Parameters: Crypto.com gives you the ability to customize your DCA strategy. You can choose the frequency of your purchases (daily, weekly, biweekly, or monthly), the sum you wish to invest each time, and the investment period. Once these parameters have been established, Crypto.com’s system will automate these purchases at the specified intervals.

DCA’s Advantages in Cryptocurrency Investing

Volatility Reduction: Cryptocurrencies are notorious for their extreme volatility. DCA reduces the risks associated with these fluctuations by spreading purchases out over time.

Lower Average Cost: The beauty of DCA resides in its potential to lower the average cost per unit over time as more units are purchased when prices are low and fewer are purchased when prices are high.

Eliminates Market Timing: The DCA strategy eliminates the tension and uncertainty associated with market timing. It eliminates the need to determine the “perfect” time to purchase.

Promotes Financial Discipline: The DCA promotes financial discipline by mandating regular investments over time, thereby reducing impetuous investment decisions influenced by market sentiments.

A Deep Dive into Crypto.com’s Supporting DCA Features

The features of Crypto.com extend beyond facilitating recurring purchases. It provides a vast array of instruments to help investors manage their DCA strategy.

Market Analysis Tools: Crypto.com offers a variety of market analysis tools to assist users in making informed decisions. Users are aided in their comprehension of market trends by real-time cryptocurrency charts and data.

Wide Range of Supported Cryptocurrencies: Crypto.com supports in excess of 250+ cryptocurrencies. This extensive selection enables users to implement DCA on a variety of assets.

Security: crypto.com employs stringent security measures, such as two-factor authentication, cold storage for cryptocurrencies, and insurance on digital assets. These features provide users with assurance when implementing DCA strategies.

Customer Support: Crypto.com’s customer support personnel are available around the clock. While configuring or administering their DCA strategy, users can readily access assistance.

Real-Life DCA Case Studies on Crypto.com Consider the following hypothetical situations to comprehend how DCA operates in actual situations:

Case Study 1: Using DCA, an investor chooses to invest in Bitcoin (BTC). They decide to invest $100 weekly for a year. Regardless of fluctuations in Bitcoin’s price, the investor purchases $100 worth of BTC every week. At the conclusion of the year, they discover that their average purchase price was less than the annual average market price of Bitcoin, resulting in a possible profit.

Case Study 2: An alternative investor prefers to invest a fixed sum in Ethereum (ETH) rather than using DCA. They buy at a time when the price of Ethereum is close to its zenith. When the price falls, they incur substantial losses. If they had employed a DCA strategy, some of these losses could have been avoided.

Let’s expand on the Bitcoin (BTC) case study:

Case Study: An investor launches a DCA strategy for Bitcoin on Crypto.com at the start of 2023. They invest $200 every two weeks, regardless of the price of Bitcoin.

The price of Bitcoin fluctuates considerably throughout 2023, reaching a high of $70,000 and a low of $30,000. However, the investor continues to invest every two weeks. By the end of the year, their average purchase price will be approximately $45,000, which is lower than the annual average market price.

In addition, the investor deposits their Bitcoin holdings into Crypto Earn, opting for the three-month term that offers a 4.5% p.a. interest rate at the time. This decision increases their Bitcoin holdings without necessitating additional purchases, thereby increasing their returns.

This scenario illustrates how, despite market volatility, a DCA strategy combined with Crypto.com’s Crypto Earn feature can result in substantial gains.

Considerations for DCA on Crypto.com

Despite the fact that DCA is a valuable strategy, it is essential to remember that cryptocurrencies carry inherent risks. You should only invest money you are willing to lose, and portfolio diversification is essential. Always conduct an extensive investigation prior to investing in cryptocurrencies. Consider the cryptocurrency’s objective, market trends, and development team.

Investment Risk: You should only invest money that you can afford to lose. The prices of cryptocurrencies can be extremely volatile.

Portfolio diversification: Entails avoiding investing all of one’s funds in a single asset or asset class. Diversifying your investments can reduce the risk of loss. Comprehend the cryptocurrency’s purpose, its market trends, the team behind it, and its long-term prospects.

Maximizing DCA Benefits on Crypto.com

Consider these additional strategies to get the most out of DCA on Crypto.com:

Stay Consistent: Consistency is the key to successful DCA investing. Regardless of market conditions, continue to invest regularly.

Long-term Strategy: The DCA is most effective as a long-term investment strategy. Be patient and allow time for your investment to flourish.

Review regularly: Review your DCA strategy frequently and make necessary adjustments. Changes in market conditions necessitate that you adapt your strategy accordingly.

Adding Crypto Earn to the DCA Strategy on Crypto.com

In addition to being a marketplace for purchasing and selling cryptocurrencies, Crypto.com also offers a feature called Crypto Earn. This enables users to earn interest on their cryptocurrency holdings, enhancing the DCA strategy.

For instance, after purchasing a cryptocurrency on a regular basis, you could choose to deposit these holdings into Crypto Earn. Depending on the parameters you choose and the particular cryptocurrency, you could earn a substantial weekly interest rate. Thus, while your DCA strategy serves to average out the purchase price, Crypto Earn may increase your overall investment return.

Dollar Cost Averaging is an effective technique for traversing the volatile cryptocurrency markets. Crypto.com’s comprehensive feature set enables users to implement and manage a DCA strategy consistent with their investment objectives.

The Crypto Earn feature of the platform adds further value to the DCA strategy by offering the possibility of increased returns. In addition, Crypto.com’s diverse selection of cryptocurrencies enables users to apply DCA to a variety of digital assets, thereby diversifying their risk exposure.

As with any investment, DCA carries inherent risks, and it is essential to make informed decisions, maintain a diversified portfolio, and adapt strategies as market conditions change. Remember that in the world of investing, consistency, perseverance, and vigilance are of the utmost importance, and the same holds true when utilizing a DCA strategy on Crypto.com.